jersey city property tax assessment

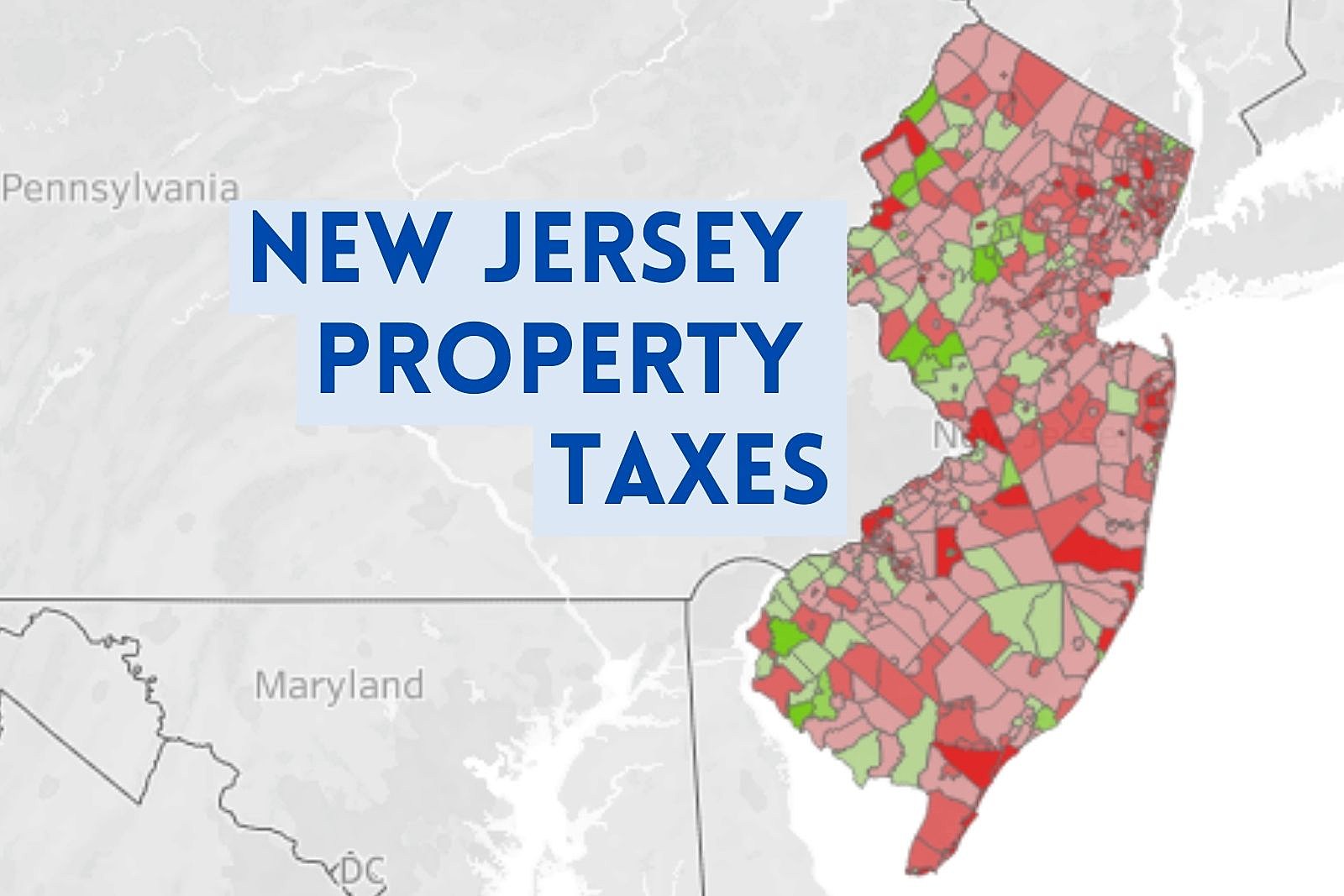

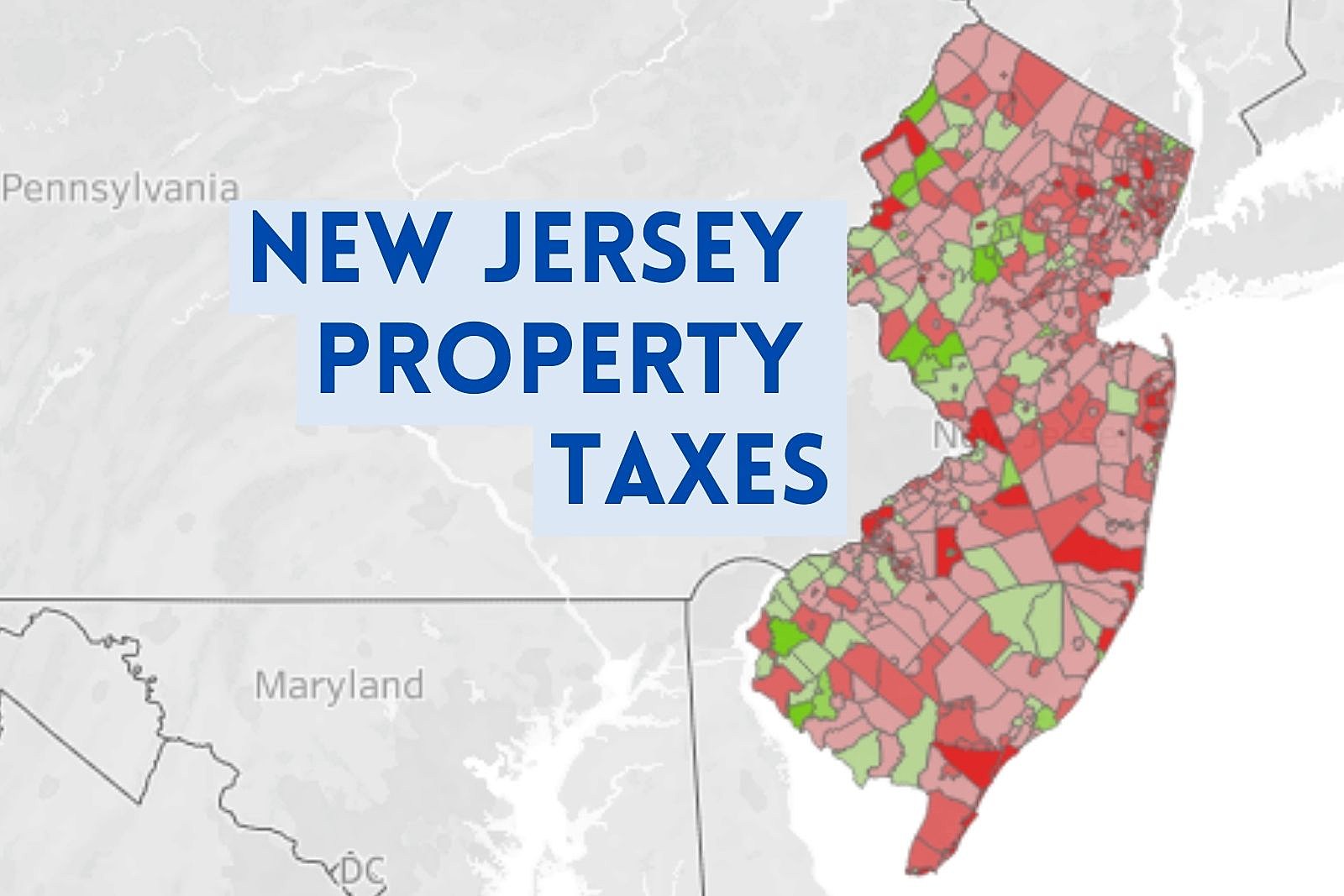

New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. Jersey City Hall 280 Grove Street Room 116.

Tax Collector S Office City Of Englewood Nj

3 To inquire about the appeals process you can contact the Hudson County Tax Board whose website is here.

. TAXES BILL 123508 000 123508 0 000. 201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey. Value all real and personal property in the city for the purposes of assessment and taxation in accordance with general law the Charter and applicable provisions of the Jersey City Code.

The city is responsible for mailing tax post cards to property owners. Dog License Film Permit Food Truck Parking Space Job with Jersey City Parking Permit Recreation Field Permit Small Business PermitLicense. In March the city council adopted an ordinance that established the levy for the arts and culture trust fund tax at one-quarter of a penny.

THE OFFICE OF THE CITY ASSESSOR SHALL. 1165 CLINTON AVENUE Bank Code. TAXES BILL 000 000 50000 0 000 2034 4.

City of Jersey City. The final rate of 148 has been officially certified by the board a tad below the 162 estimate that had been given to residents. 15906 00008 C0313X Principal.

City of Jersey City. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Additional duties include maintaining property transfers keeping current ownership updated checking building permits that have been issued and maintaining current values.

Jersey City is going through what they call here a reval where for the first time since 1988 homes are being re-evaluated for property tax purposes. The main function of the Tax Assessors Office is the appraisal and evaluation of all land and buildings within the municipality for tax purposes according to state statutes. Online Inquiry Payment.

If you have documents to send you can fax them to the. In Jersey City the average residential school tax in 2021 was. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

By using this website you acknowledge that you have read understood and agreed to the above conditions. 66 WILLOW STREET LPay Date. TAXES BILL 136861.

Across the state the average homeowner pays 4908 a year in school taxes roughly half of the average property tax bill of 9284. Property taxes are calculated based on the total assessed value of the property land value improvements value - exemptions divided by 100 and multiplied by the tax rate. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

30 NORTH BRAE CT Bank Code. PROPERTY TAXES About one third of the Citys annual budget is funded through property taxes. The assessed value is determined by the Tax Assessor.

32 PITTSFORD WAY Bank Code. You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

JERSEY CITY NJ 07302 Deductions. Online Inquiry Payment. The office of the City Assessor shall be charged with the duty of assessing real property for the purpose of general taxation.

Official records of the Jersey County Supervisor of Assessments and the Jersey County CollectorTreasurer may be reviewed at the Jersey County Government Building 200 North Lafayette St Jerseyville IL 62052. 17904 00016 Principal. The 148 is per every 100 of assessed.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Ad Find Out the Market Value of Any Property and Past Sale Prices. Contact the Jersey City tax office if you dont yet have your updated assessment or cannot find your tax record.

TENAFLY NJ 07670 Deductions. Get driving directions to this office. 11 rows City of Jersey City.

Mayor Steve Fulop hailed the news on Twitter writing that this is the 5th year we have kept the municipal tax rate stable and adding he was proud of that. Library Marriage License Information Mental Health Crisis Resources Municipal Auctions Parking Information Press Releases Property Tax. Online Inquiry Payment.

Online Inquiry Payment. Jersey City New Jersey 07302. City of Jersey City.

Because its been so long and so much has. You can also locate your tax record online here. NEW PROVIDENCE NJ 07974 Deductions.

26102 00009 C5418.

Jersey City Tax Officials To Meet With Port Liberte Residents Unhappy With Pending Tax Hikes Nj Com

People Fled From These High Tax States During 2020

Township Of Nutley New Jersey Property Tax Calculator

The Ten Lowest Property Tax Towns In Nj

Township Of Nutley New Jersey Property Tax Calculator

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

The Jersey City Real Estate Market Stats Trends For 2022

The Ten Lowest Property Tax Towns In Nj

The Ten Lowest Property Tax Towns In Nj

Freehold Township Sample Tax Bill And Explanation

New Jersey Business Personal Property Tax A Guide

The Official Website Of City Of Union City Nj Tax Department

Tax Assessor Paterson New Jersey